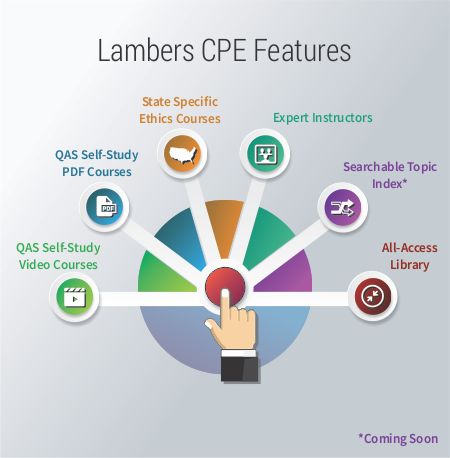

Lambers CPE offers a growing library of Continuing Professional Education Courses for CPAs. Lambers CPE Courses are video on demand to get you the credit where and when you need it. These courses are taught by Lambers instructors who are well known in their specialized fields.

The Lambers catalog of CPE Courses covers NASBA fields of study such as Taxes, Auditing, Management, Personal Development, Ethics, Information Technology and Marketing. As a CPA you may be looking to sharpen your current skill set, find a new way to market your firm or just get some last minute needed credit to satisfy your CPE requirements. Whichever category you fall into Lambers has a CPE solution that will fit your needs.

Lambers is a trusted name in exam prep and continuing education since 1966, offering quality courses for CPA, Enrolled Agent, CMA and CIA Reviews. In addition Lambers offers IRS CE Courses for Tax Preparers.

Should you have any questions please email us at: continuinged@lambers.com

Bookmark this page and check back regularly for new course additions.

Get a full year of unlimited online video

CPE for one low price!

Subscribe to Lambers One Year Unlimited CPE and have access to all of our online CPE Courses. Highlights include:

- 24/7 Access to the Lambers CPE Course Catalog for one full year

- Online Video/.PDF Courses offering well-constructed lessons on relevant topics

- Courses taught by well-known Lambers Instructors

- Store and Print your certificate of completion

- Get your CPE Credit on your schedule

Lambers adds new courses to the CPE Course Catalog every month and updates the content regularly to stay current with relevant topics.

Buy your one year subscription now for only $499.95*!

(Regular price: $699.95. Act now, offer ends soon!)

| SKU | Course Title | Hours |

|---|---|---|

| Field of Study: Taxes | ||

| CPE-06-031 | Top Ten Tips To Help Your Clients Avoid Penalties | 4 |

| CPE-06-032 | Top Tips to Avoid Preparer Penalties | 3 |

| CPE-06-148 | Tax Preparers’ prayers answered: Tax Issues for the Clergy | 2 |

| CPE-06-154 | Individual Retirement Accounts | 4 |

| CPE-07-118 | Estate Taxes | 6 |

| CPE-07-119 | Gift Taxes | 3 |

| CPE-07-120 | Individual Retirement Accounts | 3 |

| CPE-06-162 | Tax Minimization Strategies When Computing Corporate Taxable Income | 1 |

| CPE-06-166 | Qualified Business Income Deduction: Tax Planning Opportunities and Pitfalls | 2 |

| CPE-06-167 | International Tax Case Study: Foreign Investment into the US (Inbound) | 1 |

| CPE-06-169 | Tax Minimization Strategies When Computing Corporate Alternative Minimum Tax (AMT) | 2 |

| CPE-06-170 | Expatriation: Top Ten International Tax Topics for people renouncing US citizenship or transferred / seconded to foreign affiliates | 1 |

| CPE-06-176 | Tax Planning Strategies When Making Shareholder Distributions After 2017 | 2 |

| CPE-06-177 | Schedule M-1 Disclosure of Book-Tax Differences after 2017 | 2 |

| CPE-06-178 | Individual Filing Requirements | 2 |

| CPE-06-184 | US Outbound International Tax After 2017 Tax Reform – The State of Play As We Head Into the ’20s Conditions Leading to the 2017 Act, and the Overall Systemic Changes it Introduced | 1 |

| CPE-06-185 | US Outbound International Tax After 2017 Tax Reform – The State of Play As We Head Into the ’20s Regimes Introduced by the 2017 Act, and Prospects for Future Changes | 1 |

| CPE-06-186 | General Taxation of Foreign Investments | 2 |

| CPE-06-187 | Ponzi Scheme Theft Loss | 1 |

| CPE-06-188 | Pre-Immigration Tax Planning | 1 |

| CPE-06-230 | Love and Marriage | 2 |

| Field of Study: Regulatory Ethics: Technical | ||

| CPE-06-039 | IRS Professional Responsibilities, Practice and Procedure | 2 |

| CPE-06-001 | Ethics Update: Circular 230 Changes and Hot Topics | 2 |

| CPE-06-006 | Ethics and Professional Responsibilities from a Tax Perspective | 2 |

| CPE-06-125 | Professional Responsibilities and Quality Control for CPAs | 2 |

| CPE-06-122 | Governmental Auditing Standards | 1 |

| CPE-07-011 | EITC Due Diligence | 3 |

| CPE-07-016 | Tax Return Preparer Ethical Issues | 4 |

| CPE-07-055 | Madoff: A Case Study in the AICPA Code of Conduct | 2 |

| CPE-06-147 | Tax Preparers Gone Bad: Volume I | 2 |

| CPE-07-148 | Ethics for Accountants: Alaska | 4 |

| CPE-07-135 | Ethics for Accountants: Arizona | 4 |

| CPE-07-146 | Ethics for Accountants: Arkansas | 3 |

| CPE-07-149 | Ethics for Accountants: California | 4 |

| CPE-07-150 | Ethics for Accountants: Colorado | 4 |

| CPE-07-151 | Ethics for Accountants: Connecticut | 4 |

| CPE-07-136 | Ethics for Accountants: Delaware | 4 |

| CPE-07-152 | Ethics for Accountants: District of Columbia | 4 |

| CPE-07-134 | Ethics for Accountants: Florida | 4 |

| CPE-07-153 | Ethics for Accountants: Hawaii | 4 |

| CPE-07-154 | Ethics for Accountants: Idaho | 4 |

| CPE-07-155 | Ethics for Accountants: Illinois | 4 |

| CPE-07-156 | Ethics for Accountants: Indiana | 4 |

| CPE-07-157 | Ethics for Accountants: Iowa | 4 |

| CPE-07-141 | Ethics for Accountants: Kansas | 2 |

| CPE-07-142 | Ethics for Accountants: Kentucky | 2 |

| CPE-07-158 | Ethics for Accountants: Maine | 4 |

| CPE-07-159 | Ethics for Accountants: Maryland | 4 |

| CPE-07-160 | Ethics for Accountants: Massachusetts | 4 |

| CPE-07-143 | Ethics for Accountants: Michigan | 2 |

| CPE-07-172 | Ethics for Accountants: Minnesota | 8 |

| CPE-07-137 | Ethics for Accountants: Mississippi | 4 |

| CPE-07-170 | Ethics for Accountants: Missouri | 6 |

| CPE-07-144 | Ethics for Accountants: Montana | 2 |

| CPE-07-161 | Ethics for Accountants: Nebraska | 4 |

| CPE-07-162 | Ethics for Accountants: Nevada | 4 |

| CPE-07-163 | Ethics for Accountants: New Hampshire | 4 |

| CPE-07-164 | Ethics for Accountants: New Mexico | 4 |

| CPE-07-138 | Ethics for Accountants: New York | 4 |

| CPE-07-139 | Ethics for Accountants: New York (Tax Concentration) | 4 |

| CPE-07-145 | Ethics for Accountants: North Carolina | 2 |

| CPE-07-147 | Ethics for Accountants: Ohio Professional Standards and Responsibilities | 3 |

| CPE-07-165 | Ethics for Accountants: Oklahoma | 4 |

| CPE-07-166 | Ethics for Accountants: Oregon | 4 |

| CPE-07-167 | Ethics for Accountants: Pennsylvania | 4 |

| CPE-07-171 | Ethics for Accountants: Rhode Island | 6 |

| CPE-07-173 | Ethics for Accountants: Utah | 4 |

| CPE-07-168 | Ethics for Accountants: Vermont | 4 |

| CPE-07-169 | Ethics for Accountants: West Virginia | 4 |

| Field of Study: Accounting | ||

| CPE-06-105 | Analyzing Financial Information to Reduce Fraud, Waste, and Abuse | 8 |

| CPE-06-109 | Financial Statement Aerobics – Toning Your Fiscal Physique Part 1 – Introduction to Financial Statement Analysis | 2 |

| CPE-06-110 | Financial Statement Aerobics – Toning Your Fiscal Physique Part 2 – Calculating and Understanding Ratios | 2 |

| CPE-06-111 | Financial Statement Aerobics – Toning Your Fiscal Physique Part 3 – Utilizing Analytical Procedures to Detect Red Flags and Potential Fraud | 2 |

| CPE-06-112 | Financial Statement Aerobics – Toning Your Fiscal Physique Part 4 – Improving the Operations of the Company | 2 |

| CPE-06-113 | Financial Statement Aerobics – Toning Your Fiscal Physique Part 1 and 2 – Introduction to Financial Statement Analysis – Calculating and Understanding Ratios | 4 |

| CPE-06-114 | Financial Statement Aerobics – Toning Your Fiscal Physique Parts 3 and 4 – Utilizing Analytical Procedures to Detect Red Flags and Potential Fraud – Improving the Operations of the Company | 4 |

| CPE-06-115 | Financial Statement Aerobics – Toning Your Fiscal Physique Parts 1 2 3 and 4 – Introduction to Financial Statement Analysis – Calculating and Understanding Ratios – Utilizing Analytical Procedures to Detect Red Flags and Potential Fraud – Improving the Operations of the Company | 8 |

| CPE-06-106 | Compilation and Preparation Standards | 4 |

| CPE-06-107 | Review Standards and Independence | 4 |

| CPE-06-108 | Compilation, Review, and Preparation Standards | 8 |

| CPE-07-025 | Internal Controls in Accounts Payable | 5 |

| CPE-07-026 | Vendor Issues in Accounts Payable | 4 |

| CPE-07-052 | Accounts Receivable Best Practices for Small to Medium Sized Commercial Entities | 2 |

| CPE-07-083 | Accounting for Liabilities – Estimation and Valuation | 4 |

| CPE-07-084 | Asset Valuation Using Discounted Cash Flows | 6 |

| CPE-07-085 | Intangible Asset Valuation | 3 |

| CPE-07-027 | An ACH (Electronic Payment) Primer: How Savvy Companies Now Pay Their Bills | 2 |

| CPE-07-028 | Emerging Payment Frauds (Cyber and Expense Related) and How to Deal with Them | 1 |

| CPE-07-029 | It’s All about Your Bottom Line: Developing Accounts Payable Issues and Practices | 11 |

| CPE-07-030 | Often-Overlooked Internal Control Breakdowns in Accounts Payable and How to Deal with Them | 1 |

| CPE-07-031 | Preparing for Year End in Accounts Payable | 2 |

| CPE-07-032 | The Developing Expense Receipt Issues and How to Deal with Them | 1 |

| CPE-07-078 | Accounting Changes and Error Corrections | 2 |

| CPE-07-079 | Accounting for Business Combinations | 4 |

| CPE-07-080 | Credit Losses on Financial Instruments | 4 |

| CPE-07-081 | Principles of Financial Statement Presentation | 3 |

| CPE-06-224 | Accounting for Leases | 3 |

| CPE-06-237 | Accounting For Consolidations | 2 |

| Field of Study: Auditing | ||

| CPE-06-120 | Completing the Audit | 1 |

| CPE-06-116 | The Attest Function and Assurances | 1 |

| CPE-06-117 | Engagement Planning | 3 |

| CPE-06-118 | The Study and Evaluation of Internal Controls | 3 |

| CPE-06-119 | Evidential Matter, Audit Programs and Working Papers | 4 |

| CPE-06-121 | The Auditor’s Report | 4 |

| CPE-06-124 | Auditing and Information Systems | 1 |

| CPE-06-103 | Implementing Efficient, Effective Internal Controls For Small to Mid-Size Businesses | 8 |

| CPE-07-069 | Fraud Audit Techniques Using Excel | 3 |

| CPE-07-176 | Complying with Government Auditing Standards and Professional Ethics | 4 |

| CPE-07-177 | Field Work and Reporting Standards for Professional Audits | 3 |

| CPE-07-178 | Government Auditing Standards and Foundations | 2 |

| CPE-07-179 | Government Auditing Standards and Performing Audits | 5 |

| CPE-07-180 | Government Auditing Standards and Professional Requirements | 3 |

| CPE-07-181 | Governmental Auditing Standards | 12 |

| CPE-07-182 | Overview of the 2018 Yellow Book and Significant Changes | 1 |

| CPE-07-183 | Standards for Financial Audits Attestation Engagements and Review of Financial Statements | 3 |

| CPE-07-193 | Performing Auditing and Other Assurance Services | 4 |

| CPE-07-194 | Auditing Evaluation and Internal Controls | 3 |

| CPE-07-195 | Audit Materiality and Risk Assessment | 2 |

| CPE-07-196 | Fraud Auditing | 2 |

| CPE-07-197 | Audit Planning | 10 |

| CPE-06-225 | Performing Auditing and Other Assurance Services | 4 |

| CPE-06-226 | Auditing Evaluation and Internal Controls | 3 |

| CPE-06-227 | Audit Materiality and Risk Assessment | 2 |

| CPE-06-228 | Fraud Auditing | 2 |

| CPE-06-229 | Audit Planning | 10 |

| Field of Study: 2 Hours Accounting/2 Hours Specialized Knowledge | ||

| CPE-06-100 | Business Ownership Transitions: Buying, Selling, and Exit Strategies Beginning the Process through Due Diligence | 4 |

| CPE-06-101 | Business Ownership Transitions: Buying, Selling, and Exit Strategies From Valuation to Closing the Deal | 4 |

| Field of Study: 4 Hours Accounting/4 Hours Specialized Knowledge | ||

| CPE-06-102 | Business Ownership Transitions: Buying, Selling, and Exit Strategies | 8 |

| Field of Study: 4 Hours Auditing/4 Hours Personal Development | ||

| CPE-06-104 | Protecting Your Organization From A Destructive Culture | 8 |

| Field of Study: Statistics – Technical | ||

| CPE-06-123 | Statistical Sampling | 2 |

| Field of Study: Computer Software and Applications-Non Technical | ||

| CPE-07-050 | Audit & Analytical uses for Filters and Tables in Excel | 2 |

| CPE-07-053 | Arrays: A Powerful Excel Tool | 3 |

| CPE-07-054 | Become an Expert on Lookup Functions | 5 |

| CPE-07-057 | Creating Custom Financial Statements using Excel | 2 |

| CPE-07-058 | Creating Custom Functions in Excel | 2 |

| CPE-07-059 | Creating Dynamic and Interactive Charts | 3 |

| CPE-07-060 | Creating Effective Charts | 5 |

| CPE-07-061 | Making Functions in Excel | 3 |

| CPE-07-062 | Drive Your Dashboard with Excel | 11 |

| CPE-07-066 | Excel Worksheets- Best Practices | 2 |

| CPE-07-067 | Financial Forecasting Tools; Using Excel and Financial Ratios to Build a Forecast | 1 |

| CPE-07-071 | Managing Data with Excel | 5 |

| CPE-07-072 | Must Know Excel Functions for CPAs | 6 |

| CPE-07-073 | Must Know Excel Tips Tricks and Tools for CPAs | 5 |

| CPE-07-074 | Optimizing Search Results with Google | 1 |

| CPE-07-075 | Use Pivot Tables to Organize, Summarize and Analyze Data | 5 |

| CPE-07-082 | Spreadsheet Controls Under Sarbanes-Oxley Section 404 | 2 |

| Field of Study: Information Technology | ||

| CPE-07-124 | Information Security – Protecting Company Data: Malware Trends and Mitigation Strategies | 6 |

| Field of Study: Business Management & Organization – Non-Technical | ||

| CPE-07-095 | Adding Financial Planning to Your CPA Practice | 6 |

| Field of Study: Computer Science and Specialized Knowledge | ||

| CPE-06-158 | Information Security: Basic Safeguards for Practitioners | 1 |

| CPE-07-121 | Information Security – Basic Safeguards for Practitioners | 6 |

| CPE-07-122 | Information Security – Network Security for Internal Control Assurance | 8 |

| Field of Study: Finance | ||

| CPE-07-093 | Equity Investing Essentials | 2 |

| CPE-07-094 | Financial Planning Basics for Individuals | 6 |

| CPE-07-096 | Insurance Basics for the Individual | 4 |

| CPE-07-097 | Investing Fundamentals and Products | 4 |

| CPE-07-098 | Life Insurance Essentials | 2 |

| CPE-06-232 | Business Loan Basics | 2 |

| CPE-06-233 | Managing Cash Flow | 3 |

| CPE-06-234 | Marginal Profitability Analysis | 2 |

| CPE-06-260 | Entrepreneurial Finance: Small Business Financial Management Basics | 6 |

| Field of Study: Management Services | ||

| CPE-07-198 | Interpersonal Skills for CPAs | 3 |

| CPE-07-199 | Agile Project Management – An Overview | 3 |

| CPE-07-200 | Managing Communications for a Financial Project | 1 |

| CPE-07-201 | Managing Conflict in a Practice | 2 |

| CPE-07-202 | Skills to Create and Run a Successful Practice | 3 |

| CPE-07-203 | Agile Quality and Process Improvement with Kanban | 5 |

| CPE-07-204 | Agile Scrum Project Management | 4 |

| CPE-07-205 | Agile Lean Process Improvement | 4 |

| CPE-07-206 | Agile XP Project Management | 4 |

| CPE-07-207 | Project Management Business Needs Assessment and Creating the Business Case | 3 |

| CPE-06-238 | An Introduction to Agile Project Management | 2 |

| CPE-06-239 | Duties When Managing a Project | 4 |

| CPE-06-240 | Effective Communication Styles for CPAs | 2 |

| CPE-06-241 | Effective Listening Styles for CPAs | 2 |

| CPE-06-242 | Improving Work Processes using Agile Kanban | 5 |

| CPE-06-243 | Improving Writing Skills for CPAs | 3 |

| CPE-06-244 | Leading Effective Meetings for CPAs | 2 |

| CPE-06-245 | What is Agile and Why Use It? | 1 |

| CPE-06-276 | Key Performance Indicators (KPIs) and KPI Dashboards | 2 |

Lambers, Inc. is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

Lambers, Inc. is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

All Lambers CPE Courses are covered by the Lambers Guarantee and Return Policy, which can be viewed here.